-

CALL US:

- (866) 952-3456

Think of professional liability insurance as your professional "safety net." It's a specific kind of coverage designed to protect your business if a client ever claims your advice or service cost them money.

This isn't your standard insurance that covers a slip-and-fall in your office. This policy zeroes in on the financial damage that can come from professional mistakes.

Let's use a real-world example. Say you’re a talented architect. If a client trips over a loose tool at your office, that's what general liability insurance is for. But what happens if a small calculation error in your blueprints leads to a massive, expensive structural problem for the client?

That’s exactly where professional liability insurance, often called errors and omissions (E&O) insurance, comes into play.

It’s your financial backstop for claims tied to things like:

Essentially, this insurance protects the brainpower behind your business—the advice, the strategy, and the expertise your clients pay you for. All it takes is one unhappy client to file a lawsuit that could cost you thousands in legal fees, even if you’re ultimately proven right. Professional liability coverage handles those defense costs, settlements, and judgments, protecting your business and your reputation.

This isn't just an optional add-on; for any service-based business, it's a core part of managing risk in today's world. It specifically covers the unique vulnerabilities that come with selling your knowledge and skills.

The market for this kind of protection speaks for itself. The global professional liability insurance market was valued at around USD 44.96 billion and is expected to keep growing. That growth really underscores how vital this coverage has become for professionals everywhere. You can dive deeper into the data on the professional liability insurance market to see the full picture.

To make it even clearer, here's a quick rundown of what we're talking about.

| Aspect | Description |

|---|---|

| Primary Purpose | Covers financial losses to a third party resulting from professional mistakes or negligence. |

| Also Known As | Errors and Omissions (E&O) Insurance. |

| Who Needs It | Service-providing professionals (consultants, designers, architects, accountants, etc.). |

| Key Coverages | Negligence, errors, omissions, misrepresentation, and inaccurate advice. |

| What It Pays For | Legal defense costs, settlements, and judgments—even for groundless claims. |

This table should give you a solid starting point. It’s the kind of protection you hope you never need, but you’ll be incredibly glad you have it if you ever do.

To put it simply, if you get paid for your professional service or advice, you're on the hook. The moment a client hands you money for your expertise, they have an expectation about the outcome. If the result doesn't quite match that expectation, that gap can quickly turn into a lawsuit.

Think about a marketing consultant hired to launch a new product. If the campaign tanks and the client loses a boatload of money, they could easily sue the consultant for giving bad advice. Even if the consultant did everything by the book, they'd still have to cough up a small fortune in legal fees just to prove it.

This is exactly where professional liability insurance steps in. It’s your financial backstop for these "what if" scenarios, covering your legal bills whether you’re at fault or not.

Sure, any service provider can get sued, but some lines of work are just bigger targets. These are the jobs where one small mistake can create a massive financial headache for a client.

It's not about being perfect. No one is. It's about having a plan for when things—or what clients perceive as things—go wrong. Professional liability insurance is how you manage that risk without betting your entire business on it.

These days, many clients won't even hire you without seeing proof of this insurance first. If you’re an independent contractor, it’s basically a non-negotiable cost of doing business. Using a solid contractor hiring checklist helps everyone get on the same page and ensures all the right protections, including insurance, are locked in before any work starts.

Let’s cut through the insurance jargon. At its core, professional liability insurance is your financial safety net for mistakes you might make while doing your job. It’s there to handle the fallout from claims of negligence, giving bad advice, or misrepresenting something.

Think of it as "oops" coverage for professionals. Imagine you're a graphic designer who accidentally uses a copyrighted photo in a big ad campaign for a client. When the owner of that photo sues, your policy would step in to cover the hefty legal defense fees and any settlement that follows.

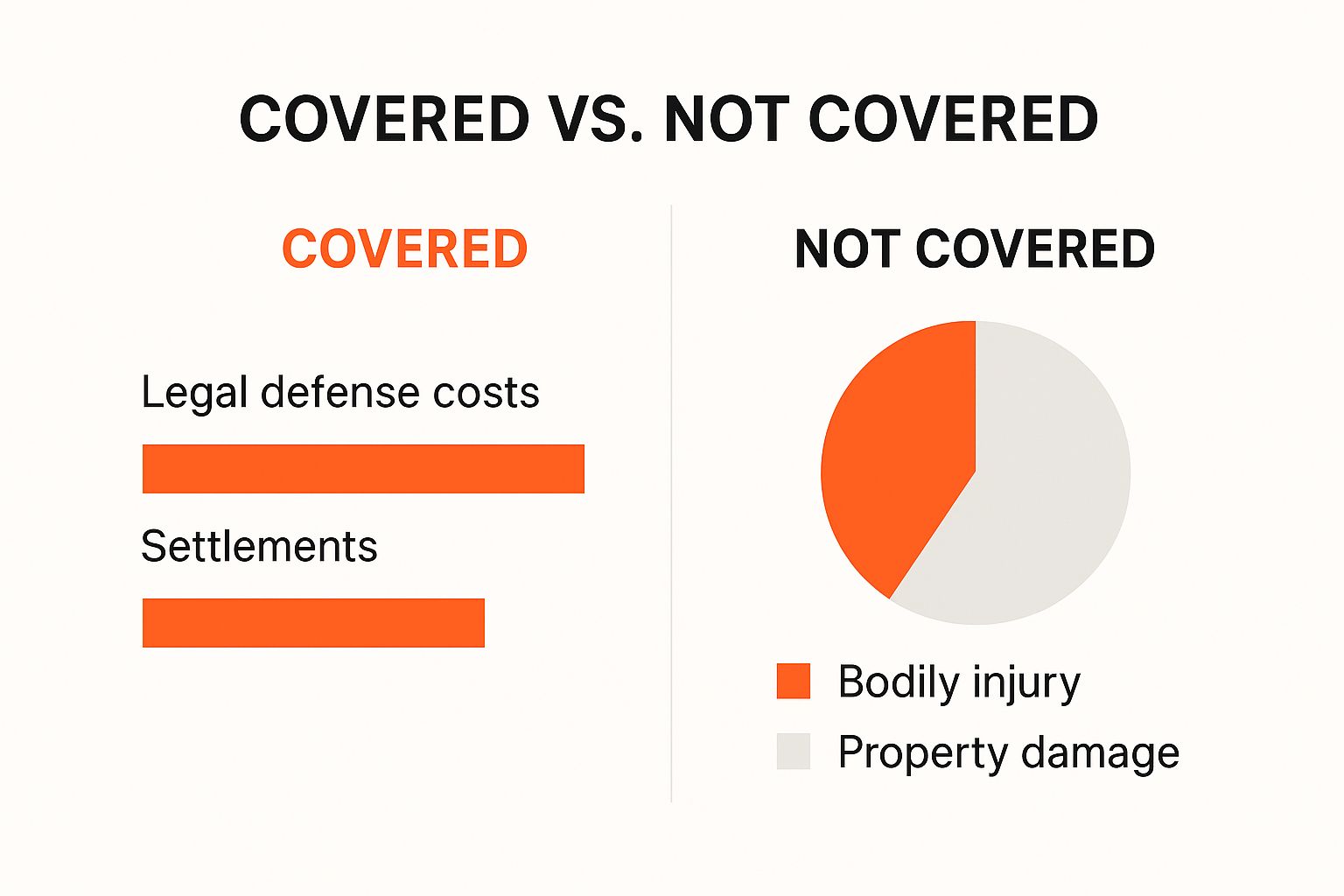

This infographic does a great job of showing what this insurance is for—and what it’s not for.

The main takeaway? This insurance is all about protecting you from financial losses caused by professional errors. It’s not for physical accidents—that's a job for general liability insurance.

A solid professional liability policy is designed to shield you from a whole range of claims. It’s not just for one specific type of slip-up; it's for the spectrum of risks you navigate every single day in your line of work.

The most critical job of professional liability insurance is paying for your legal defense. Even if a lawsuit is completely ridiculous and has no merit, you still have to hire a lawyer to fight it, and those bills pile up fast.

It's just as important to know what this insurance is not designed to do. Your policy won't cover claims related to someone getting physically hurt or property getting damaged. If a client trips over a power cord in your office and breaks their arm, that claim falls squarely under your general liability insurance, not this one.

Also, don't expect it to cover intentional bad acts or crimes. This policy is for honest mistakes and oversights, not deliberate fraud.

It's also interesting to see how the financial risks are changing. Even with more competition in the insurance market, the cost of claims just keeps climbing. For example, the average cost of a business email compromise cyber claim—a risk often tied to professional services—jumped from $84,000 to $183,000 in a single year. You can dig deeper into the evolving trends in the liability insurance market to get a better sense of what's at stake.

It’s one of the most common points of confusion for small business owners: what’s the real difference between professional liability and general liability insurance? The answer is simpler than you think. Just remember this core idea: "Mistakes vs. Mishaps."

This simple phrase draws a clear line in the sand. Professional liability insurance is all about your professional mistakes. Think errors, bad advice, or failing to deliver a promised service that causes a client a financial loss.

On the other hand, general liability is for physical mishaps. This is your classic slip-and-fall coverage, covering bodily harm or damage to someone else’s property that happens because of your business operations.

Let’s say a client visits your office and slips on a freshly mopped floor. That’s a physical mishap, and your general liability policy would kick in. But if you're an accountant and your flawed advice leads that same client to a massive financial loss, that’s a professional mistake. Your professional liability policy would be the one to respond. Seeing this distinction is the first step to building a rock-solid safety net for your business.

Seeing these policies in action side-by-side really helps clear things up. Here’s a quick breakdown of how each one responds to different real-world problems. For anyone in the trades, understanding this is especially important, and you can dive deeper into specific contractor insurance requirements to see how these policies work together on the job.

Let's put the two head-to-head to make the differences crystal clear.

| Feature | Professional Liability (E&O) | General Liability (CGL) |

|---|---|---|

| Core Focus | Protects against financial loss due to professional errors or negligence. | Protects against third-party bodily injury and property damage. |

| Claim Example 1 | A web developer's faulty code causes their client's site to crash, resulting in lost sales. | A customer trips over a tool bag in your workspace and breaks their ankle. |

| Claim Example 2 | An architect’s design flaw requires expensive rework during construction. | Your employee accidentally knocks over a priceless vase at a client’s home. |

At the end of the day, it boils down to this: one policy protects your work, and the other protects your workplace and physical actions. Most service-based businesses need both. Without both, you’re leaving a huge, and potentially very expensive, gap in your company's protection.

Ever wonder how insurance companies come up with that final number on your premium quote? It’s not just a dart thrown at a board. They're essentially playing risk analyst, looking at your business from every angle to figure out the likelihood of you facing a claim.

Think of it this way: an architect who makes a mistake could cause a million-dollar structural failure. A freelance writer's error, while still serious, probably won't have the same financial fallout. The bigger the potential claim, the more risk the insurer takes on—and that's reflected in the price.

To get to that final number, underwriters dig deep into the specifics of your business. They’re looking for any clues that point to high or low risk.

The underwriting process is really just a deep dive into your business's risk profile. Insurers will look at everything from your client contracts to your quality control checklists to get a sense of how likely a future claim might be.

While you can't change your profession, you have more control over your insurance costs than you might realize. Your best defense is a good offense. A clean, claim-free history is your number one asset because it proves you're a low-risk client.

Solid record-keeping and iron-clad client contracts can also dramatically lower your risk profile. Taking the time to understand all the moving parts is key. For a more detailed breakdown, this guide on Professional Liability Insurance Cost is a great resource.

It’s completely normal to have a few lingering questions when you’re looking at professional liability insurance. Even with a solid grasp of the basics, some specific situations can be tricky. Let’s clear up a few of the most common ones that pop up.

A big one we hear all the time is about business structures. Many people think that because they have an LLC, they're off the hook for this kind of coverage. While it's true an LLC protects your personal stuff (like your house and car) from business debts, it does absolutely nothing to protect the business itself from a lawsuit.

If a client sues your company for a mistake, your E&O insurance is what steps in to handle the legal bills and any potential settlement. It’s the policy that keeps your business’s bank account safe.

Another point of confusion is how the policies are structured. Most professional liability policies are what’s known as “claims-made.” This is a critical detail. It means the policy has to be active when the claim is filed, not just when the work was originally done.

This is exactly why letting your coverage lapse is such a risky move. You could be on the hook for a project you completed years ago, facing a huge financial headache you never saw coming. For anyone providing a service, keeping that coverage continuous is just part of being a professional, which we see all the time with our partners in home repair and handyman services.

Think of a claims-made policy like a security system subscription. As long as it's active, you're protected. If you cancel it, the cameras go dark, and you’re exposed—even to things that happened while it was on.

Finally, have you ever wondered why some clients demand you carry this insurance just to get the contract? It’s not because they don’t trust you. It’s actually a smart business move on their part to make sure you have the financial muscle to fix a major mistake if one happens.

Having that policy shows you’re a serious, stable professional. It’s a standard practice in a global liability insurance market valued at a whopping USD 291.86 billion. That number alone shows you how vital this protection is. For anyone worried about the cost, it’s worth exploring all your options for finding affordable E&O insurance.

Ready to protect your hard work with professional assembly? Assembly Smart ensures your furniture, equipment, and play sets are put together correctly and safely, minimizing risks from the start. Get your free estimate today!